Blogs

“Third-Party Posts”

Results From the 2024 Retirement Confidence Survey Find Workers’ and Retirees’ Confidence Has Not Recovered From the Significant Drop Seen in 2023, but Majorities Remain Optimistic About Retirement Prospects

Summary - However, almost 8 in 10 workers and 7 in 10 retirees are concerned that the U. S. government could make significant changes to the American retirement system...

2024 Pulse of the American Retiree Survey: Midlife Retirement ‘Crisis’ or a 10-Year Opportunity?

Critically underprepared for retirement, 55-year-old Americans enter a crucial 10-year countdown to plan and prepare With just a decade until retirement, 55-year-old...

Why Retirees Are Carrying More and More Debt

Federal Reserve data shows sharp rise in amount Americans 65 and older owe Americans across generations are carrying more debt than they did three decades ago,...

3 Changes Coming To Retirement Required Minimum Distributions in 2025

Saving and investing early, often, and continuously throughout your entire working career is absolutely critical to securing your financial future in retirement. Making...

3 Changes Are Coming to 401(k) Plans in 2025

Three significant 401(k) plan changes coming in 2025 are worth paying attention to, regardless of when you plan to retire, whether you work full-time or part-time, or...

6 Retirement Savings Changes To Expect in 2025

Big changes are coming to retirement savings in 2025. The shifts in retirement planning come after Congress passed the Setting Every Community Up for Retirement...

7 Things to Know About Working While Getting Social Security

If you claim benefits early, income from work can reduce your monthly payments “Retirement” used to be synonymous with “not working.” Not anymore. More than a quarter...

Weekly Market Commentary

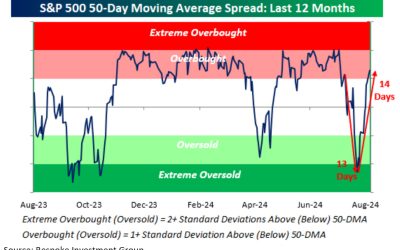

The S&P 500 notched its 39th record high in 2024 on the back of a fifty-basis-point rate cut by the Federal Reserve. Global central banks took center stage this...

Weekly Market Commentary

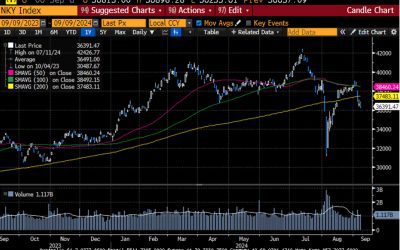

-Darren Leavitt, CFA Markets bounced back nicely in the second week of September. It was an intriguing week of trade with several undercurrents to consider. The first...

Weekly Market Commentary

-Darren Leavitt, CFA Global equity markets tumbled due to economic growth concerns as the US Treasuries extended their gains from August. The holiday-shortened week...

Weekly Market Commentary

-Darren Leavitt, CFA The final week of August was all about NVidia's second-quarter earnings results and the Fed's preferred measure of inflation, the PCE. Expectations...

Weekly Market Commentary

-Darren Leavitt, CFA US financial markets inked another week of gains as investors cheered what they heard from global central bankers at the Jackson Hole Economic...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Charter Financial Group) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Charter Financial Group.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

The “Still-Working Exception” and December 31 Retirement

By Ian Berger, JD IRA Analyst As the end of the year approaches, you may have plans to retire on December 31. However, if you are using the “still-working exception” to...

2025 Year-End Retirement Account Deadlines

By Sarah Brenner, JD Director of Retirement Education The end of the year always brings a flurry of retirement account deadlines and planning opportunities. This...

Qualified Distributions and Successor Beneficiaries: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: Dear IRA Help, Here is my specific case. I am 84 years old. I opened a Roth IRA on March 30,...

Do QCDs Actually Reduce AGI?

By Andy Ives, CFP®, AIF® IRA Analyst It has come to our attention that confusion exists as to how qualified charitable distributions (QCDs) impact one’s taxes....

Trump Accounts and the Pro-Rata Rule: Today’s Slott Report Mailbag

By Ian Berger, JD IRA Analyst Question: We have two grandchildren. One is 18 years old now, and the other will turn 18 next January (2026). Can you help me...

Avoiding the 10% Early Distribution Penalty for Certain Hardship Withdrawals

By Ian Berger, JD IRA Analyst Most 401(k) plans (as well as 403(b) and 457(b) plans) offer hardship withdrawals while you are still employed. If the withdrawal comes...

Tapping an ESA for Back-to-School Expenses

By Sarah Brenner, JD Director of Retirement Education It’s August and that means it is back-to-school time! The 2025-2026 school year is upon us. Kids are already back...

The Once-Per-Year Rollover Rule and SEP IRA Contributions: Today’s Slott Report Mailbag

By Sarah Brenner, JD Director of Retirement Education Question: I recently retired in January and rolled over a lump sum pension from my previous employer into my IRA....

The Craziest Stuff I’ve Heard

By Andy Ives, CFP®, AIF® IRA Analyst The Ed Slott team has answered literally tens of thousands of IRA and retirement plan questions over the past few years. That is...

Will My Specialist’s Services be Covered under My Medicare Plan?

Whether you’re switching from one type of Medicare coverage to another, or you’re new to Medicare, you might be concerned about being able to continue seeing your health-care specialist. Will your specialist’s services be covered by Medicare? That may depend upon:...

7 Medicare Changes You’ll See in 2025

Expensive medications? You’ll save thousands. Dementia or mental health care? More options Key takeaways Changes from Inflation Reduction Act will take effect next year. Lower out-of-pocket limit in Part D drug plans erases old “donut hole.” You may find weight loss...

How Medicare Advantage In-Home Health Assessments Keep Seniors Healthier

Today, Medicare Advantage delivers affordable, high-quality care to more than 33 million seniors and people with disabilities, with better health outcomes than Fee-for-Service Medicare (FFS). One of the most effective ways to ensure seniors receive comprehensive care...

Does your Medicare plan cover gym memberships and other fitness benefits?

There’s no age limit on exercise – physical activity is for everyone! In fact, as you get older, physical activity becomes an even more important part of your overall health. According to the Centers for Disease Control and Prevention, regular exercise can help...

Your annual physical checklist

Annual physical check-ups are essential in maintaining your health. These check-ups can identify health issues in their early stages, so you can take care of them as early as possible. If you have Medicare and have had Medicare Part B for more than 12 months, you...

LEARN DENTAL INSURANCE BASICS AND SAVE YOUR TEETH

Monitoring your oral health isn’t just about good teeth: it can give insight into your overall health. There are many reasons why it’s important that you visit your dentist regularly. Dental health should be a major concern for seniors. Monitoring your oral health...

MEDICARE AND DEPRESSION TREATMENTS — WHAT MEDICARE COVERS

Mental health is a critical part of overall health. Conversations on the topic of mental health were rare when the baby boomer generation was young. Today, the topic is far more accepted. Mental health is a critical part of overall health. Conversations on the topic...

WHY CHOOSE A MEDICARE SUPPLEMENT PLAN?

Whether you need medical care while traveling, in the comfort of home, or you want the flexibility to see any medical doctor or specialist that accepts Medicare, a Medicare Supplement plan may be just what you need. As you prepare for the next chapter of your journey,...

Find a Charter Financial Group Location

Daytona Beach, Florida

1616 Concierge Blvd., 1st Floor – #100

Daytona Beach, FL 32117

Office: 386-492-9472

Or: 239-244-8644

Mark@CharterFinGroup.com